Union Federal Student Loans Overview

Information Composed by Jake McCall, Verified by Monogram LLC

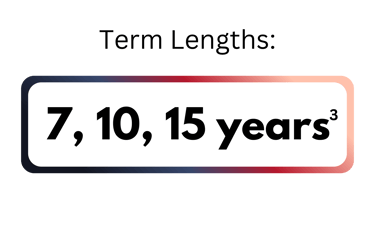

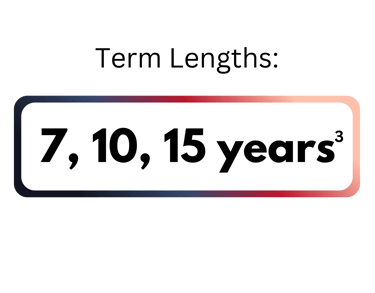

Union Federal® Private Student Loans are available to student borrowers with and without a cosigner. Union Federal loans offer competitive rates and a variety of borrower benefits such as a 0.25% interest rate reduction when you elect auto pay (1) and an automatic 0.25% interest rate reduction for making on-time payments (2). Borrowers can choose from four different repayment options (defer payments, interest only payments, flat payments or immediate repayment (3)) and three different repayment terms (7-, 10-, 15-years (3)). Cosigner release is also available upon entering repayment of principal and interest (4).

Quick Overview

Company Details

Union Federal Private Student Loans are funded by Citizens Bank and are originated by Monogram LLC, a company whose team has been in the student loan space for decades and maintains an A rating overall according to the BBB (Better Business Bureau). Union Federal is unique in that it offers loans to international students with a US cosigner (5). The company also offers payment relief plans in case of job loss (6), natural disasters (7), and other unexpected hardships (8) to help mitigate the risk for borrowers.

We may be paid compensation for the products offered below. This by no means influences what we say or how we portray those products. Pluto is meant to help, not hinder your education funding.

The Union Federal No-Essay Scholarship Sweepstakes (9)!

A $1,500 scholarship could be in your future. Union Federal is sponsoring a $1,500 scholarship every month until December 31, 2025. That's a total of 67 winners and $100,500 going towards students to help them cover the costs of books, tuition, housing, and more!

NO PAYMENT OR PURCHASE NECESSARY IN ORDER TO WIN

Takes about 5 minutes

Union Federal at a Glance

Loan repayment terms offered include 7-, 10-, or 15-year terms (3) along with four different repayment options to choose from (3) for both undergraduate and graduate students.

No application fee, processing fee, or late fees. Plus, up to a 12-month grace period (11).

A 0.25% interest rate discount when you elect auto pay discount (1) plus an automatic 0.25% interest rate reduction for making on-time payments (2).

Available to international students with a U.S. cosigner (5).

Does not offer student loan refinancing or parent loans.

Students without a cosigner may apply for a Union Federal Loan. For students who apply with a cosigner, cosigner release is available upon entering repayment of principal and interest (4).

Union Federal Returning Borrower Advantage (5)

When you apply for subsequent loans with a cosigner, you may not have to provide income documentation again. This makes the application process easier and faster.

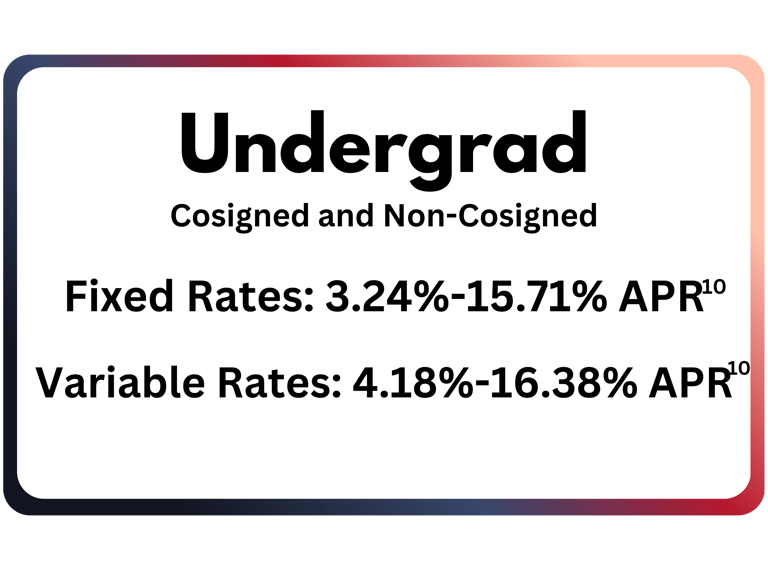

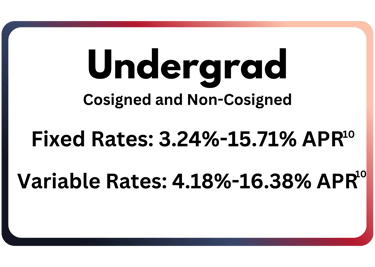

Undergrad Loans

Associates, Bachelors

Union Federal Undergraduate Loans

Union Federal offers well-rounded, customizable loans with four different available repayment options (3) and three different repayment terms (7-, 10-, or 15-years (3)). A 2% principal reduction can be requested after graduation (2). Although applying with a cosigner is recommended, it is not required. However, keep in mind that approval is more likely when applying with a parent or another adult with good financial standing. Plus, you may get a lower rate than you would if you applied solo. And cosigner release is available upon entering repayment of principal and interest (4). Union Federal also offers multiple payment relief options in case of job loss (6), natural disasters (7) and other unexpected hardships (8).

Automatic 0.25% interest rate reduction for making on-time payments (2)

Four repayment options to choose from (3)

DACA recipients are eligible with a US cosigner (5)

0.25% interest rate discount when you elect auto pay (1)

7-, 10-, 15- year repayment terms to choose from (3)

Payment relief in case of job loss (6), natural disasters (7), or hardship (8)

Apply for cosigner release upon entering repayment of principal and interest (4)

Borrow as little as $1,000 up to $99,999, not to exceed the aggregate student loan debt limit of $180,000 (12)

No late fees, application fees or processing fees

Key Undergraduate Features

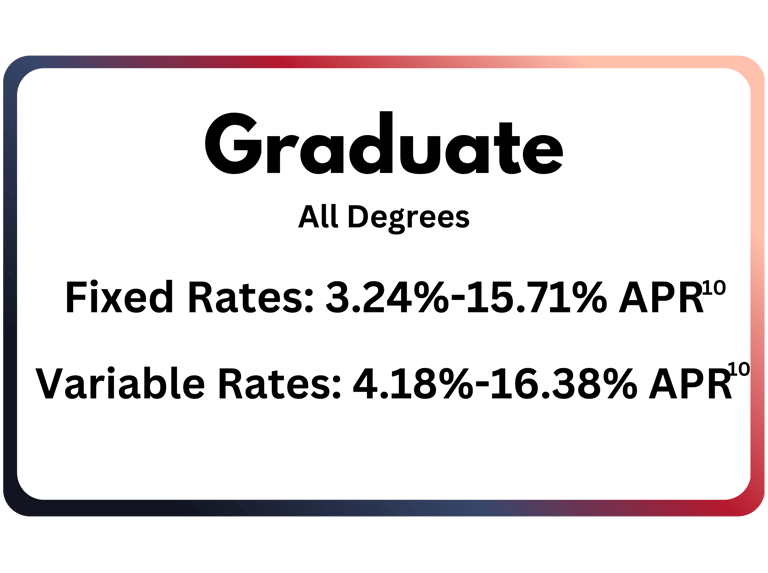

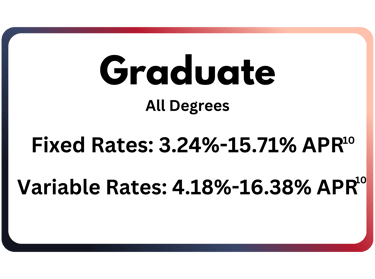

Graduate Loans

Business, Medical, Dental, Law, Health, and More

Union Federal Graduate Loans

Union Federal offers graduate loans for nearly all degree types, with comparable interest rates and a well-rounded array of borrower benefits. Customization is key, with four repayment options (3) and three repayment terms (7-, 10-, and 15-years) to choose from (3). You can receive an automatic 0.25% interest rate reduction for making on-time payments (2) and an additional 0.25% interest rate reduction when you elect auto pay (1).

Automatic 0.25% interest rate reduction for making on-time payments (2)

DACA recipients are eligible with a US cosigner (5)

Borrow between $1,001 and $99,999 not to exceed the aggregate student loan debt limit of $180,000 (12)

Payment relief in case of job loss (6), natural disasters (7), or hardship (8).

7-, 10-, 15-year repayment terms to choose from (3)

Four repayment options to choose from (3)

No late fees, application fees or processing fees

Apply for cosigner release upon entering repayment of principal and interest (4)

0.25% interest rate reduction when you elect auto pay (1)

Key Graduate Features

Did You Know...

That student loan rates can change rapidly every month? Don't miss the updates. We'll keep you posted on changing rates and more!

Disclosures:

Before applying for a private student loan, Citizens Bank N.A. and Monogram LLC recommend exhausting all financial aid alternatives including grants, scholarships, and federal student loans.

The Union Federal® Private Student Loan is made by Citizens (“Lender”). All loans are subject to individual approval and adherence to Lender’s underwriting guidelines. Program restrictions and other terms and conditions apply. LENDER AND MONOGRAM LLC EACH RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. TERMS, CONDITIONS AND RATES ARE SUBJECT TO CHANGE AT ANY TIME WITHOUT NOTICE.

(1) Earn a 0.25% interest rate reduction for making automatic payments of principal and interest from a bank account (“auto pay discount”) by completing the direct debit form provided by the Servicer. The auto pay discount is in addition to other discounts. The auto pay discount will be applied after the Servicer validates your bank account information. Automatic payments and the associated discount will be temporarily discontinued (1) if you elect to stop automatic deduction of payments and (2) during periods when you are not required to make payments. The discount will be permanently discontinued in the event three automatic deductions are returned by the financial institution for any reason. The auto pay discount is not available when reduced payments are being made or when the loan is in a deferment.

(2) The 0.25% interest rate reduction will automatically be applied if the first 36 consecutive monthly principal and interest payments during the repayment term are received by the Servicer within 10 calendar days after their due date. Payments made prior to the start of the repayment term or during a deferment or forbearance do not count toward the number of required monthly payments.

(3) The four repayment options include Flat Payment Repayment (paying $25 per month during in-school deferment), Full Deferment, Interest only Repayment and Immediate Repayment. The 15-year term and Flat Payment Repayment option are only available for loan amounts of $5,000 or more. Certain repayment terms and/or options may not be available depending on the applicant’s debt-to-income ratio. Making interest only or flat interest payments during deferment will not reduce the principal balance of the loan. Payment examples (all assume a 14-month deferment period, a six-month grace period before entering repayment, no auto pay discount, and the Interest Only Repayment option): 7-year term: $10,000 loan, one disbursement, with a 7-year repayment term (84 months) and a 9.06% APR would result in a monthly principal and interest payment of $161.20. 10-year term: $10,000 loan, one disbursement, with a 10-year repayment term (120 months) and a 8.78% APR would result in a monthly principal and interest payment of $125.49. 15-year term: $10,000 loan, one disbursement, with, a 15-year repayment term (180 months) and a 8.82% APR would result in a monthly principal and interest payment of $100.36.

(4) A cosigner may be released from the loan upon request to the Servicer, provided that the student borrower has met certain credit and other criteria at the time of the request. Use of an approved reduced repayment plan will disqualify the loan from being eligible for this benefit. If a request for cosigner release is denied, reapplication is not permitted for at least 12 months from the previous cosigner release application date.

(5) The student must be the legal age of majority at the time of application, or at least 17 years of age if applying with a cosigner who meets the age of majority requirements in the cosigner's state of residence. The legal age of majority is 18 years of age in every state except Nebraska (19 years old, only for wards of the state), and Puerto Rico (21 years old). Private student loans funded by Citizens are available to applicants who are U.S. citizens, permanent resident aliens, or Eligible Non-Citizens (DACA recipients). Eligible Non-Citizens (DACA recipients) must apply with an eligible cosigner who is a U.S. citizen or permanent resident alien. International students can apply for the Union Federal Private Student Loan with an eligible cosigner who is a U.S. citizen or permanent resident alien. Students enrolled less than half-time are not eligible to apply.

(6) Available in increments of no more than two (2) months, for a maximum period of twelve (12) months. To be eligible for unemployment protection a required number of monthly principal and interest payments must have been made and the loan cannot be more than fifty-nine (59) days delinquent. During unemployment protection, principal and interest payments are deferred and the interest that accrues during the unemployment protection period may be capitalized at the expiration of such period in accordance with the Credit Agreement. To be eligible for more than one incremental period of unemployment protection, (a) at least twelve (12) monthly principal and interest payments must be satisfied following the prior period of unemployment protection and (b) the borrower cannot have utilized more than two (2) periods of unemployment protection in the five (5) years prior to the last day of the most recent unemployment protection period. The number of months of unemployment protection utilized counts towards the total number of months of forbearance permitted on the loan. The repayment term will be extended by the total number of months of unemployment protection applied to the loan.

(7) Natural Disaster Forbearance is afforded at the lender’s discretion based on guidance from the Federal Emergency Management Agency (“FEMA”).

(8) Available in increments of no more than two months, for a maximum period of 12 months. To be eligible for forbearance a required number of monthly principal and interest payments must have been made and the loan cannot be more than fifty-nine (59) days delinquent. During a forbearance period, principal and interest payments are deferred and the interest that accrues during the forbearance period may be capitalized at the expiration of such forbearance period. To be eligible for more than one incremental period of forbearance, (a) at least twelve (12) monthly principal and interest payments must be satisfied following the prior period of forbearance and (b) the borrower cannot have utilized more than two (2) forbearance periods in the five (5) years prior to the last day of the most recent forbearance period. The repayment term will be extended month-for-month for the number of months of forbearance applied to the loan.

(9) NO PURCHASE OR PAYMENT NECESSARY TO ENTER OR WIN. Open to legal residents of the 50 U.S./D.C., age 18+, who are currently a student or parent of a student enrolled in an undergraduate program at an Eligible Institution. An “Eligible Institution” must be: (i) based in the United States; (ii) Title IV eligible according to data from the U.S. Department of Education; and (iii) categorized as a public or private school that offers bachelor’s degree program or higher according to the U.S. Department of Education, excluding for-profit schools (proprietary schools). Void outside the 50 U.S./D.C. and where prohibited. Sweepstakes starts at 12:00:01 AM ET on 05/28/20; ends at 11:59:59 PM ET on 12/31/2025. Total ARV of prize per Entry Period: $1,500; Total ARV of all prizes: $100,500. Odds of winning will depend on the total number of entries received for each Entry Period. For full Official Rules, visit https://sweeps.smartborrowing.org/paying-for-college-sweepstakes-official-rules/. Sponsor: Monogram LLC, 200 Clarendon Street, 20th Floor, Boston, MA 02116.

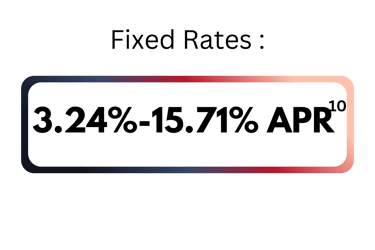

(10) Interest rates and APRs (Annual Percentage Rates) depend upon (1) the student’s and cosigner’s (if applicable) credit histories, (2) the repayment option and repayment term selected, (3) the expected number of years in deferment, (4) the requested loan amount and (5) other information provided on the online loan application. If approved, applicants will be notified of the rate applicable to your loan. Rates and terms are effective as of 10/1/25. The lowest APRs assume a $10,000 loan with one disbursement, a 7-year term, and the Immediate Repayment option with payments beginning 30-60 days after the disbursement via auto pay (see footnote 1 above). The variable interest rate for each calendar month is calculated by adding the 30-Day Average Secured Overnight Financing Rate (“SOFR”) index, or a replacement index if the SOFR index is no longer available, plus a fixed margin assigned to each loan. The SOFR index is published on the website of the Federal Reserve Bank of New York. The current SOFR index is 4.34% as of 8/1/25. The variable interest rate will change if the SOFR index changes or if a new index is chosen. The applicable index or margin for variable rate loans may change over time and result in a different APR than shown. The fixed rate assigned to a loan will never change except as required by law or if you request and qualify for the auto pay discount (see footnote 1 above).

(11) The grace period is generally the earlier of six months from the date (a) the student borrower graduates, (b) the student borrower drops below half-time status, or (c) that is 60 months from the first disbursement date, but in no case, earlier than six months after the first disbursement date. The immediate repayment option does not have a grace period. The extended grace period is six months from either (a) the day following the initial grace period, (b) the first day of delinquency during the repayment term, or (c) the due date of the current level bill. To be eligible for the extended grace period, the loan cannot have entered the repayment term more than ninety (90) days prior to the date the Servicer receives the request for payment relief. The immediate repayment option does not have an extended grace period. The repayment term will be extended month-for-month for the number of months of extended grace applied to the loan.

(12) The minimum loan amount is $1,000 except for student applicants who are permanent residents of Iowa in which case the minimum loan amount is $1,001. The maximum annual loan amount to cover in-school expenses for each academic year is determined by the school’s cost of attendance, minus other financial aid, such as federal student loans, scholarships, or grants, up to $99,999 annually. The loan amount must be certified by the school. The loan amount cannot cause the aggregate maximum student loan debt (which includes federal and private student loans) to exceed $180,000 per applicant (on cosigned applications, separate calculations are performed for the student and cosigner).

(13) A Returning Borrower is a student applicant or a cosigner with either (a) a prior application that is awaiting school certification, or (b) a prior loan that has a disbursement scheduled or completed. Income verification will be waived for Returning Borrowers who report the same employer, employment status, singular income source and an annual income amount within 25% of the annual income amount previously verified from such income source on a prior application or loan with an income verified date within eighteen (18) months of the hard pull decision date of the new application. If more than one prior application or loan with an income verified date within eighteen (18) months of the hard pull decision date for the creditworthy applicant exists, the most recent qualifying application or loan will be used to verify income.